Income Tax Login 2025:- The Income Tax e-filing portal is a crucial tool for Indian taxpayers to file their returns, track refunds, and manage tax payments seamlessly. With the advancements in digital taxation, completing the Income Tax login and registration process ensures quick and secure access to various online services. Let’s dive into how you can access the portal and make the most of its features.

Income Tax Login 2025

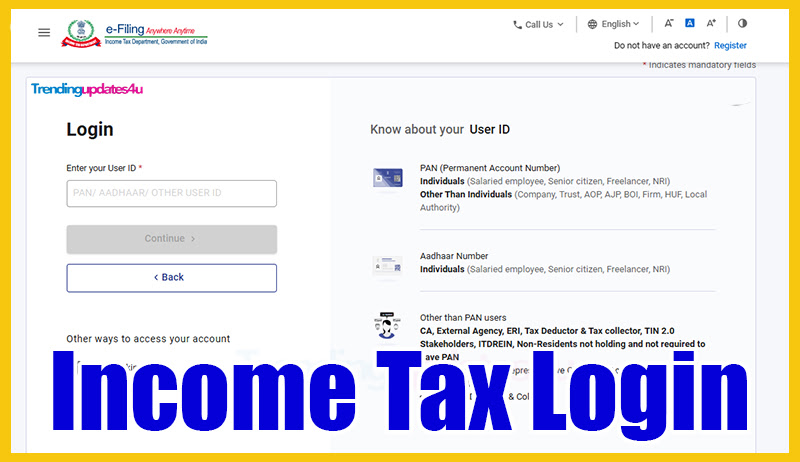

To file your income tax returns online, the first crucial step is completing the income tax login and registration process. This allows you to access the Income Tax Department’s e-filing website, where you can submit returns and explore a range of tax-related services. To begin, visit the official Income Tax login portal at https://eportal.incometax.gov.in/.

Once on the website, follow the steps outlined below to complete the login and registration process. After successfully logging in, you’ll unlock access to various services, including filing your tax returns, tracking refund statuses, and making tax payments. The portal provides user-friendly prompts to help you navigate these processes effortlessly.

Completing the income tax login and registration process is vital for anyone filing their taxes online. It streamlines the process, saving you time and ensuring your returns are submitted accurately and promptly.

Check This:- DAM Capital Advisors IPO

Income Tax Login Details

| Topic | Description |

| Article for | Income Tax Login |

| Purpose | To access the Income Tax e-filing portal and its various services. |

| Required Documents | Email address, mobile number, and PAN number. |

| Login Method | Using credentials (User ID and Password) or Aadhaar OTP. |

| Login Portal | https://eportal.incometax.gov.in/ |

| Services Available | Filing income tax returns, tracking refund status, making tax payments, viewing tax credit statements, e-verifying returns, and more. |

| Assistance | Helpdesk: 1800 103 0025 / +91-80-4612 2000, Email: efiling@incometax.gov.in |

| Security Measures | Two-factor authentication, Captcha verification, User ID and password protection, Aadhaar OTP, and other safeguards. |

| Category | Finance |

Income Tax Login Portal

If you wish to register for Income Tax or log in to the Income Tax portal, here’s how:

- Visit the e-Filing portal homepage and click “Login”.

- Enter your User ID in the designated textbox and click “Continue”.

- Verify your Secure Access Message.

- Enter your Password and click “Continue”.

Once logged in, you can access a wide range of tax-related services. Keep your login credentials secure for future use.

Read Also:- Income Tax Updates

Income Tax Return Filing

To file your Income Tax Return (ITR) online, follow these steps:

- Go to the official Income Tax website and log in using your User ID and Password.

- Click on “e-File” and select “Income Tax Return” from the drop-down menu.

- Choose the appropriate ITR form and assessment year.

- Download the pre-filled XML file and save it to your computer.

- Return to the e-Filing portal and upload the saved XML file.

- Click “Submit” to file your ITR.

- Verify your ITR using Aadhaar details or by generating an Electronic Verification Code (EVC).

After verification, you’ll receive an acknowledgment from the Income Tax Department.

Income Tax Payment

The Income Tax login portal is also essential for making tax payments. By logging in, you can:

- File Income Tax Returns.

- Check refund status.

- Make online Income Tax payments.

- Access other tax-related services.

If you need further assistance with the login or payment process, visit the official Income Tax website or consult a qualified tax professional.

Can Check:- ITR Filing Last Date

How to Check Income Tax Refund Status?

To check your Income Tax refund status, visit the official Income Tax website and follow the process outlined below:

- Navigate to the homepage of the e-Filing portal https://eportal.incometax.gov.in/.

- Click on “Income Tax Return (ITR) Status”.

- On the ITR Status page, enter your acknowledgment number and a valid mobile number, then click “Continue”.

- Enter the 6-digit OTP sent to your mobile number and click “Submit”.

- Your Income Tax refund status will be displayed.

For further assistance or updates, you can also explore related services, such as the Income Tax login.

Services Available on the e-Filing Portal

Once logged in, you can access a wide range of services, including:

- Filing ITRs

- Tracking Refund Status

- Downloading Form 26AS

- Making Online Tax Payments

- e-Verifying Returns

Helpful Links:

- Income Tax Login: Click Here

- DJ Portal: https://trendingupdates4u.com

By following these steps and utilizing the official resources, you can efficiently manage your Income Tax-related activities.

Conclusion

The Income Tax Login 2025 process ensures seamless access to the Income Tax Department’s e-Filing portal. Whether you’re filing returns, checking refunds, or making payments, the portal simplifies compliance for all taxpayers. For detailed assistance, visit the official website or contact the helpline.

FAQ’s

What is the Income Tax Login process?

The Income Tax Login process involves creating an account on the Income Tax Department’s e-filing portal using your PAN, mobile number, and email ID. Once registered, you can log in using your credentials to access various tax-related services.

Where can I access the Income Tax Login portal?

You can access the Income Tax Login portal at https://eportal.incometax.gov.in/.

What documents are required for Income Tax Login?

To complete the login process, you’ll need:

- Your PAN (Permanent Account Number)

- A valid mobile number

- An active email ID

How can I register on the Income Tax e-filing portal?

Follow these steps to register:

- Visit the official website: https://eportal.incometax.gov.in/.

- Click on the “Register” option.

- Enter your PAN and other required details.

- Verify your email ID and mobile number via OTP.

- Set up a secure password and complete the registration process.

Can I log in using Aadhaar OTP?

Yes, if your Aadhaar is linked with your PAN, you can log in using Aadhaar OTP. Select the “Aadhaar OTP” option during login, enter the OTP sent to your registered mobile number, and access your account.

How can I check my Income Tax refund status?

- Log in to the e-filing portal.

- Click on “Income Tax Return Status.”

- Enter your acknowledgment number and mobile number.

- Verify the OTP sent to your mobile.

- View your refund status.

Can I access the portal on mobile devices?

Yes, the e-filing portal is mobile-friendly and can be accessed via a smartphone or tablet.

Related Posts:-